International Trade Compliance Services: A Strategic Guide for Global Business Success

In today’s interconnected global economy, businesses face a labyrinth of regulations, sanctions, and customs requirements. Non-compliance can lead to crippling fines, shipment delays, and reputational damage. International trade compliance services provide the expertise and tools to navigate this complexity, ensuring seamless cross-border operations.

This guide explores why compliance matters, key components of effective programs, and how to implement them strategically.

Why International Trade Compliance Matters

1. Avoid Penalties: Regulatory bodies like OFAC (Office of Foreign Assets Control) and BIS (Bureau of Industry and Security) issued over $1.2 billion in fines globally in 2023 for violations.

2. Supply Chain Integrity: Compliance ensures goods move without delays, avoiding costly hold-ups at customs.

3. Reputation Protection: Ethical trade practices build trust with partners and customers.

4. Market Access: Compliance unlocks opportunities in regulated industries (e.g., defense, healthcare).

Core Components of Trade Compliance Services

1. Regulatory Monitoring & Classification

• Export Control Laws: Classify products under frameworks like EAR (Export Administration Regulations) and ITAR (International Traffic in Arms Regulations).

• HS Codes: Accurately assign Harmonized System codes to avoid customs disputes.

• Sanctions Screening: Real-time checks against OFAC, EU, and UN sanctions lists.

2. Customs Compliance

• Duty Optimization: Leverage free trade agreements (e.g., USMCA, CPTPP) to reduce tariffs.

• Documentation Accuracy: Ensure commercial invoices, certificates of origin, and bills of lading meet local requirements.

3. Risk Management

• Restricted Party Screening: Automatically flag high-risk entities using AI-driven tools.

• Embargo Compliance: Navigate geopolitical restrictions (e.g., Russia sanctions, China’s Entity List).

4. Training & Audits

• Employee Education: Train teams on INCOTERMS, anti-bribery laws (FCPA/UK Bribery Act), and export controls.

• Internal Audits: Identify gaps in processes before regulators do.

5. Technology Integration

• Compliance Software: Platforms like Descartes or SAP GTS automate screenings, license management, and reporting.

• Blockchain: Enhance supply chain transparency for industries like conflict minerals or pharmaceuticals.

How to Choose a Compliance Service Provider

1. Industry Expertise: Prioritize providers with experience in your sector (e.g., aerospace, fintech).

2. Global Coverage: Ensure support for all markets where you operate, including emerging economies.

3. Technology Stack: Opt for AI-powered platforms with real-time updates on regulatory changes.

4. Scalability: Solutions should grow with your business, from SMEs to multinationals.

5. Track Record: Verify success in resolving audits, customs disputes, or penalty mitigation.

Best Practices for Implementation

• Map Your Supply Chain: Identify choke points (e.g., dual-use goods, sanctioned suppliers).

• Centralize Data: Integrate ERP systems with compliance tools for unified oversight.

• Partner with Local Experts: Engage in-region consultants for nuances like EU GDPR or China’s PIPL.

• Stay Proactive: Monitor geopolitical shifts (e.g., U.S.-China trade tensions, Brexit impacts).

The Future of Trade Compliance

AI & Predictive Analytics: Forecast regulatory changes using machine learning (e.g., shifting sanctions trends).

ESR (Ethical Supply Chain Reporting): Align compliance with ESG goals to meet investor demands.

Global Standardization: Initiatives like the WTO’s Trade Facilitation Agreement aim to simplify processes.

Conclusion

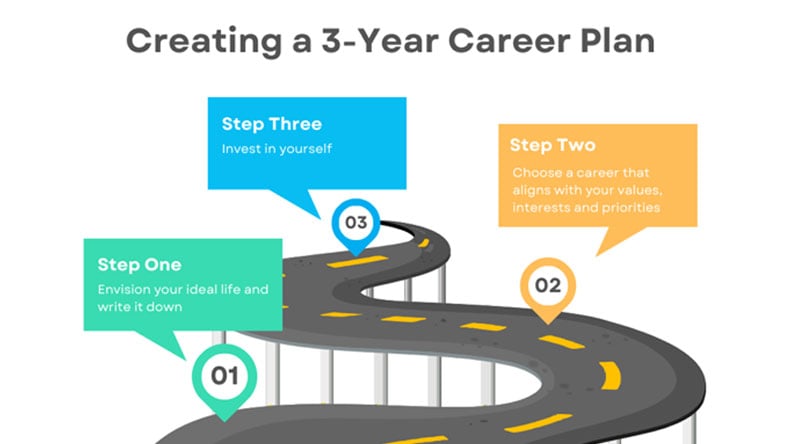

International trade compliance is not a cost center—it’s a competitive advantage. By partnering with skilled providers and adopting agile strategies, businesses can turn regulatory hurdles into opportunities for growth. Start with a compliance gap analysis, invest in training, and leverage technology to future-proof your operations.

* Act Now: Non-compliance costs the average company 4.7% of annual revenue (Deloitte, 2023). Transform risk into resilience today.

This guide equips businesses to master compliance complexities, ensuring smoother operations and sustainable global expansion.